- Over 180 of 300 airlines around the world achieved a 90% or higher on-time arrival since February 2020.

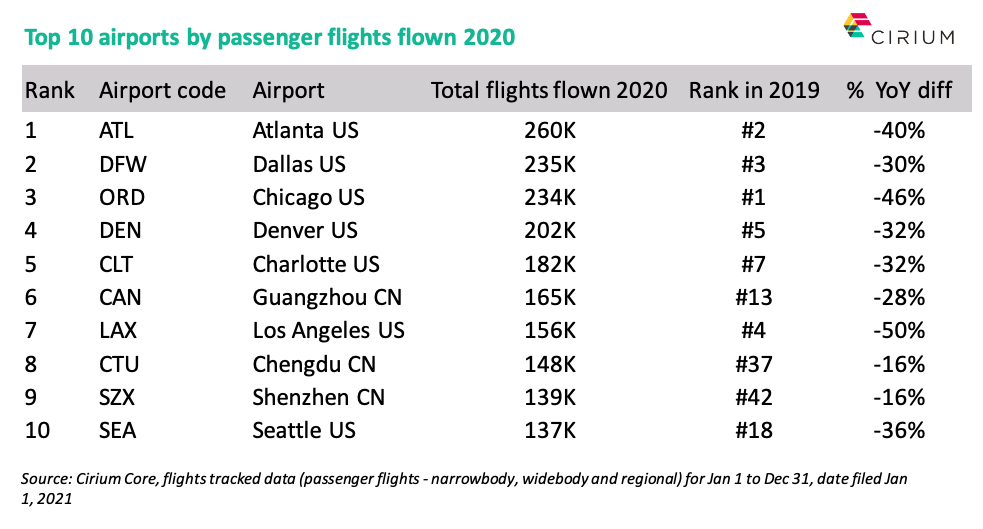

- Atlanta was the busiest airport globally based on flights operated in 2020, taking the top spot from Chicago O’Hare; Three Chinese airports vaulted into the top 10 global airports by flights operated.

- 76% of Chinese passenger flights operated despite the pandemic. The US (58%), India (50%) and UK (33%) saw major reductions in flight volume.

- Southwest Airlines operated the most flights in 2020; China Southern Airlines, China Eastern Airlines and Air China climbed in the top 10 airlines.

(BUSINESS WIRE)-- Over 180 of the major global airlines were on time in 2020, according to a new report by Cirium, the global aviation data company. The Cirium Airline Insights Review 2020 reveals that only 30 major airlines achieved this standard pre-pandemic. But over 60%—or 180 of 300 airlines globally—achieved a 90% or higher on-time arrival percentage since February 2020.

On-time performance of the top 300 global airlines significantly improved as COVID-19 reduced the number of flights in the air. In 2020, airlines only flew half of the flights flown the previous year.

“The pandemic caused a significant reduction in flight volume with airlines operating 49% fewer flights in 2020. The factors that normally cause flight delays didn’t exist, such as congestion at the airport. Overall global passenger traffic was down in 2020 by 67% from the previous year,” said Jeremy Bowen, CEO of Cirium.

Cirium’s top 10 league table for flights operated by country shows that the majority of flights were operated in the US, despite a 42% year-over-year drop in the market. China maintained its position, with only 24% of that market’s flights down versus 2019.

Japan overtook India, moving up to 3rd place as India’s flights were down 50% versus 2019. The UK was hit heavily with 67% of flights down compared to last year, moving it to 8th place from 5th. Russia moved from 10th place in 2019 to 5th in 2020 and Indonesia moved into the top 10.

|

Top 10 countries by passenger flights flown 2020

|

|

Rank

|

Country

|

Total flights flown 2020

|

Rank in 2019

|

% YoY diff

|

|

1

|

United States

|

5.1M

|

#1

|

-42%

|

|

2

|

China

|

3.4M

|

#2

|

-24%

|

|

3

|

Japan

|

638K

|

#4

|

-43%

|

|

4

|

India

|

592K

|

#3

|

-50%

|

|

5

|

Russia

|

486K

|

#10

|

-34%

|

|

6

|

Brazil

|

382K

|

#9

|

-53%

|

|

7

|

Spain

|

352K

|

#7

|

-61%

|

|

8

|

United Kingdom

|

340K

|

#5

|

-67%

|

|

9

|

Indonesia

|

333K

|

#12

|

-53%

|

|

10

|

Mexico

|

332K

|

#15

|

-44%

|

|

Source: Cirium Core, flights tracked data (passenger flights - narrowbody, widebody and regional) for Jan 1 to Dec 31, date filed Jan 1, 2021

|

Asia-Pacific carriers recovered much quicker in 2020 than their global peers and rose in the rankings in flights operated. Out of the top 10 global airlines, China Southern Airlines’ passenger flights only dropped 28% versus 2019. United Airlines was the most impacted of the top 10, with a 54% drop in flights flown versus 2019.

No European carriers feature in the 2020 list. Ryanair moved to 13th place (from 6th) as the airline’s flights flown were down 72% versus the year before. Lufthansa was 11th in 2019 but missed out on the 2020 top 10, finishing at 29th place as flights flown dropped by 69% in 2020.

|

Top 10 airlines by passenger flights flown 2020

|

|

Rank

|

Airline code

|

Airline

|

Total flights flown 2020

|

Rank in 2019

|

% YoY diff

|

|

1

|

WN

|

Southwest Airlines

|

896K

|

#1

|

-34%

|

|

2

|

AA

|

American Airlines

|

622K

|

#3

|

-44%

|

|

3

|

DL

|

Delta Air Lines

|

619K

|

#2

|

-46%

|

|

4

|

OO

|

SkyWest Airlines

|

597K

|

#4

|

-30%

|

|

5

|

CZ

|

China Southern Airlines

|

521K

|

#7

|

-28%

|

|

6

|

UA

|

United Airlines

|

372K

|

#5

|

-54%

|

|

7

|

MU

|

China Eastern Airlines

|

321K

|

#9

|

-33%

|

|

8

|

CA

|

Air China

|

312K

|

#10

|

-30%

|

|

9

|

6E

|

IndiGo

|

281K

|

#8

|

-45%

|

|

10

|

YX

|

Republic Airways

|

217K

|

#15

|

-37%

|

|

Source: Cirium Core, flights tracked data (passenger flights - narrowbody, widebody and regional) for Jan 1 to Dec 31, date filed Jan 1, 2021

|

“Domestic travel has recovered faster and airlines with a dominant domestic market come back quicker,” Bowen said. “That is especially the case in Asia-Pacific where recovery is more positive. The US and Europe have experienced setbacks with government-enforced restrictions and additional waves of COVID-19 affecting travel.”

Travel restrictions and the shift to more leisure travel versus business travel changed the top 10 league table for flights flown by airport extensively.

Chicago O’Hare is usually the busiest airport globally for passenger flights, however the pandemic caused a 46% reduction in flights for the airport in 2020. Three Chinese airports—Guangzhou Baiyun, Chengdu Shuangliu, and Shenzhen Bao’an—moved into the global top 10 busiest airports by arriving passenger flights.

|

Top 10 airports by passenger flights flown 2020

|

|

Rank

|

Airport code

|

Airport

|

Total flights flown 2020

|

Rank in 2019

|

% YoY diff

|

|

1

|

ATL

|

Atlanta US

|

260K

|

#2

|

-40%

|

|

2

|

DFW

|

Dallas US

|

235K

|

#3

|

-30%

|

|

3

|

ORD

|

Chicago US

|

234K

|

#1

|

-46%

|

|

4

|

DEN

|

Denver US

|

202K

|

#5

|

-32%

|

|

5

|

CLT

|

Charlotte US

|

182K

|

#7

|

-32%

|

|

6

|

CAN

|

Guangzhou CN

|

165K

|

#13

|

-28%

|

|

7

|

LAX

|

Los Angeles US

|

156K

|

#4

|

-50%

|

|

8

|

CTU

|

Chengdu CN

|

148K

|

#37

|

-16%

|

|

9

|

SZX

|

Shenzhen CN

|

139K

|

#42

|

-16%

|

|

10

|

SEA

|

Seattle US

|

137K

|

#18

|

-36%

|

|

Source: Cirium Core, flights tracked data (passenger flights - narrowbody, widebody and regional) for Jan 1 to Dec 31, date filed Jan 1, 2021

|

In 2019, London Heathrow was the 9th busiest airport for flights flown. In 2020, it ranked 31st and flights operating there were down 61% versus 2019. Amsterdam Airport Schiphol was the busiest airport in Europe. Flight operations there dropped 57% in 2020 and as a result the airport sits at 27th globally.

The Cirium Airline Insights Review 2020 provides additional insights on 2020 air travel industry and includes The On-Time Performance Review 2020 by Cirium.

To read the full Cirium Airline Insights Review 2020 – click here.

Note to editors:

Data for the passenger flights flown is based on set criteria, which includes passenger flights only (including combination flights – passenger and cargo) that are scheduled and aircraft market classes of narrowbody, widebody, and regional jets. It excludes other types, such as cargo and business jet flights, as well as unscheduled flights.

For further information please visit www.cirium.com and follow Cirium updates via LinkedIn and Twitter.

About Cirium

Cirium brings together powerful data and analytics to keep the world moving. Delivering insight, built from decades of experience in the sector, enabling travel companies, aircraft manufacturers, airports, airlines and financial institutions, among others, to make logical and informed decisions which shape the future of travel, growing revenues and enhancing customer experiences. Cirium is part of RELX, a global provider of information-based analytics and decision tools for professional and business customers.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210104005632/en/